Art Advisory

Known for his penchant for straight talk and distinguished by his trajectory as a self-made connoisseur, Ralph DeLuca stands out as an art advisor and leading consultant in the industry. His profound understanding of the art world comes from decades of real-world experience.

As an avid collector, DeLuca has navigated the modern dilemmas facing collectors today. This first-hand experience enables him to empathize with his clients and effectively advocate for them in every acquisition. He meticulously conducts comprehensive research and due diligence, aligns acquisitions with collection goals, and scrutinizes the cultural significance of each artwork—ensuring that every decision reflects his clients’ best interests.

Budgetary considerations are integral to DeLuca’s decision-making process on behalf of clients. This includes not only an analysis of the long-term value of each acquisition but also diligently sourcing the best shipping quotes or insurance coverage. DeLuca demonstrates a profound appreciation for fiscal responsibility, taking pride in his conservative approach to financial matters and providing unparalleled advice.

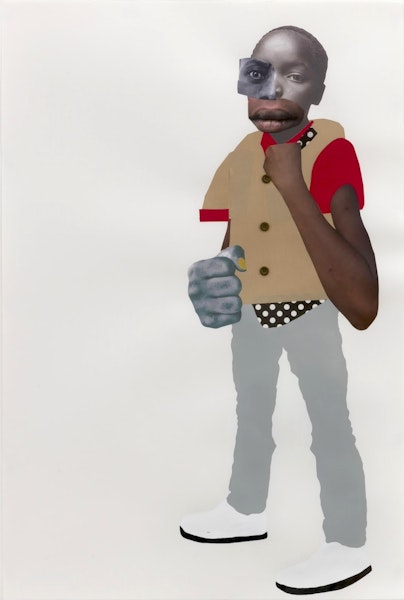

Ben, 2024

Beyond facilitating remarkable acquisitions, Ralph DeLuca Art Advisory offers comprehensive support for collection building and management. His full-service treatment includes all elements of the care and maintenance of fine art collections: overseeing every aspect from shipping and installation to conservation, appraisals, insurance matters, maintaining extensive records, archiving high resolution images, and even sourcing independent appraisals to guarantee impartial and precise valuations.

Working closely with his clients, DeLuca develops a strategy tailored to their individual needs and interests. Central to his approach is his commitment to art education. He firmly believes that while learning about clients’ interests and goals is essential to building their fine art collections, equally important is equipping them with information. DeLuca recognizes that informed collectors are going to build stronger collections and be happier with their decisions.

Throughout his 20+ year career, DeLuca has cultivated expertise that spans from recognizing emerging talent to collaborating with globally acclaimed artists. Clients benefit from his deep knowledge of the gallery system and meticulous attention to the dynamic landscape of both the primary and secondary markets, ensuring they stay ahead of global trends. Because he intuitively understands the assessments and decisions with which his clients are faced, he is able to provide a menu of options in any situation.

DeLuca’s network across the art world—ranging from artists, museums, multinational blue-chip galleries, emerging gallerists, prestigious auction houses, to private dealers—combined with his reputation in the field as an honest, thoughtful, and diligent partner allow him to provide his clients unrivaled insight into the industry and invaluable access to the most desired artworks.

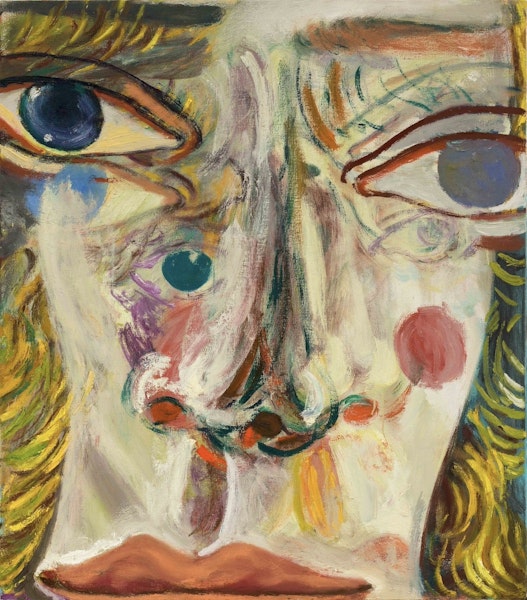

The Good Ship, 2023

“You’re going to make very costly mistakes on your own, or you pay an advisor a fee to save you from those mistakes.”

Q & A

What services does an art advisor provide?

The contemporary art market is a complex system which is opaque and inaccessible to uninformed collectors. An art advisor offers guidance for their clients. They are actively connected to dealers and artists, and provide the entry and expertise to acquire sought-after works.

With the extraordinary boom of the contemporary market in recent years, the globalization of art’s production and display, and the prevalence of art fairs and auctions, collecting is changing at a rapid pace. A successful art advisor anticipates these changing conditions and equips clients with the knowledge and guidance they require.

What is the difference between the primary and secondary market?

The primary art market refers to the original sale of an artwork, either through a gallery or directly from the artist’s studio. The primary market typically involves guiding the careers of living artists and selling their work in exchange for a commission. The secondary market involves the buying and selling of previously owned work. Selling works on the secondary market involves following a work’s subsequent changes in provenance and valuation over time.

Why work with an advisor?

An art advisor leverages their connections with collectors, dealers, and auction houses to locate work coming to market and secure access to works by sought-after artists. Art advisors keep up to date with artists, source works for clients, conduct price research and due diligence, and skillfully negotiate transactions. Galleries are increasingly working with trusted advisors to place in-demand works with collectors they trust.

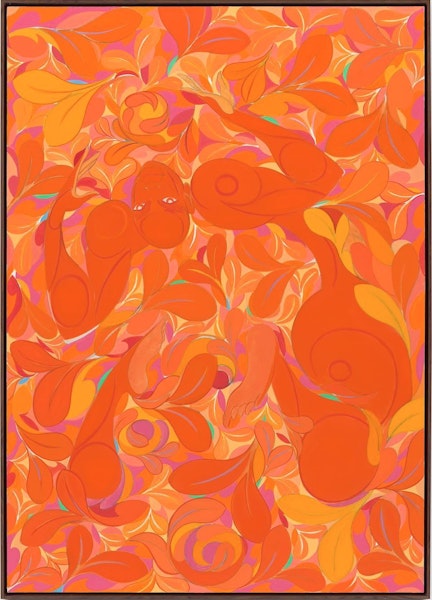

Scattered Butlers, 2023

Read More

A GUIDE FOR COLLECTORS AND INVESTORS

WHAT IS ART ADVISORY?

Art advisors provide tailored expertise to individuals or institutions in building and managing their art collections over time. Ralph DeLuca specializes in providing established and emerging collectors access to contemporary art, with a special focus on long-term value. As an advisor, DeLuca acts as an advocate for clients by conducting extensive research on their behalf and meticulously monitoring the art market. By frequenting auctions, art fairs, artist studios, galleries, and private viewings, DeLuca always has a pulse on the market.

A skilled art advisor like DeLuca not only offers in-depth knowledge and advice, but also acts as an equally attentive listener, ensuring that advice is customized to meet a client’s unique requirements and interests.

A strong advisor-client relationship is characterized as a collaborative effort to achieve the client’s objectives. Advisors should foster open communication and ongoing dialogue to establish actionable targets—and uphold accountability to their client for achieving these goals.

BENEFITS OF ART ADVISORY SERVICES

A wide range of individuals and organizations can work with and benefit from having an art advisor, including:

- New collectors who need guidance of acquiring and curating works

- Seasoned collectors seeking to expand or reorganize their collections

- investors interested in art as an investment who need insights of market trends and valuations

- Estate executors with significant art holdings requiring valuation

- Corporations looking to enhance their spaces with art or build corporate collections

The benefits of having an art advisor vary significantly, as they largely depend on the advisor’s expertise and connections. Working with an advisor like DeLuca, clients are provided with invaluable access and strategic guidance to build their dream art collections. Opportunities such as private sales, early access to art fairs, and artist studio visits allow DeLuca’s clients access to highly sought-after artworks before they reach the broader market. Additionally, DeLuca negotiates with dealers, galleries, and auction houses on behalf of his clients, ensuring favorable terms.

Strategic investment guidance is another benefit of having an art advisor like DeLuca. As a key player in the art market, he provides incomparable insights into market trends, pricing dynamics, and potential investment opportunities—such as discerning which artworks will appreciate in value.

Having an art advisor also mitigates risk; advisors conduct thorough due diligence and authentication processes to ensure the legitimacy and provenance of artworks, saving clients from acquiring counterfeit or misrepresented works. Additionally, a skilled advisor takes factors such as market liquidity and tax implications into consideration when assisting a client with deaccessioning.

In addition to financial guidance, another significant benefit of having an art advisor is the expertise they offer in legacy planning and estate management. DeLuca has extensive experience helping clients develop comprehensive legacy plans for their blue-chip art collections. These strategies include estate planning, philanthropic initiatives, and long-term preservation.

Other collection goals often include supporting emerging artists and building a collection that highlights new talent and innovation. For collectors who are particularly interested in supporting emerging artists and building a collection that showcases new talent and innovation, DeLuca offers a highly personalized approach. By collaborating closely with these clients, he is able to provide tailored recommendations that align with their unique preferences and goals, introducing them to promising new artists and forward-thinking gallery programs.

WHAT IS THE DIFFERENCE BETWEEN AN ART ADVISOR AND CONSULTANT?

Although art consultants and art advisors are often used interchangeably, the main difference between the two is that an art advisor has a fiduciary responsibility to only one client and is expected to uphold complete transparency on all dealings—including their profit.

A misconception is that art advisors have conflicts of interest with galleries or auction houses. Reputable advisors maintain ethical standards and avoid conflicts to ensure they act in the best interest of their clients. Whereas consultants may charge fees to both the seller of the artwork and the client purchasing the work, art advisors should only be compensated by their client—to ensure each acquisition is impartial, and in their client’s best interest. Art advisors operate with a transparent and pre-agreed fee structure. Consultants, like art dealers, often earn commissions at their discretion.

NAVIGATING THE ART MARKET WITH AN ART ADVISOR VS CONSULTANT

An art advisor typically offers the same broad range of services that extend beyond acquisition guidance as an art consultant, but with a personalized approach. Because art advisors often prioritize building close relationships with their clients, their guidance and personal recommendations are tailored to a client’s individual needs. Art consultants are typically hired on for short-term projects (such as assisting a hotel with selecting artworks to fill their lobby); whereas art advisors work with their clients long-term to develop their collection. While art advisors can certainly assist corporate clients with acquiring artworks for their lobbies, they are often hired on long-term and might also assist with selecting artwork for a client’s home and office as well. Art advisors might regularly work with a client’s family office or interior designer.

The cost to hire an art advisor versus an art consultant vary as well. Art advisors operate with a transparent and pre-agreed fee structure, usually a flat rate of 10%, whereas consultants often earn commissions at their discretion and bill at hourly rates.

While still providing expertise in sourcing and evaluating artworks, art advisors also adopt a more holistic approach to collection management and strategic planning. This may include advising clients on portfolio diversification, art market analysis, estate planning, and long-term investment strategies. The role of an art advisor is multifaceted, encompassing a diverse array of services tailored to the client's individual needs and objectives. From overseeing the conservation and maintenance of art collections to facilitating installations and sourcing appraisals and insurance coverage, art advisors serve as comprehensive resources for collectors seeking to maximize the value and enjoyment of their investment in their collection.

FINDING THE RIGHT ART ADVISOR

For most collectors, building a collection brings them joy, inspiration, and curatorial satisfaction. Working with a trusted partner who advocates on behalf of a client’s best interest should enhance this experience and be enjoyable. For many of his clients, Ralph has become a close friend.

When finding the right art advisor, collectors should seek comprehensive support—an advisor should be reliably capable of assisting a client in navigating any situation. According to DeLuca, transparency is equally important and worth prioritizing. Not only does it ensure a trusting and mutually beneficial relationship between the advisor and the client, but it also facilitates confidence. Clients feel reassured throughout any acquisition knowing that their advisor has their backs and are making informed decisions. This trust relies on advisors openly sharing information about market trends, the reasoning behind their recommendations, and even their fee structure.

Advisors like DeLuca take pride in transparency and hold themselves accountable for their actions and decisions. An advisor should be open about their processes, adhere to industry regulations, and always operate within legal and ethical boundaries. When finding a reputable art advisor, research is paramount. Collectors should utilize online resources and art market publications for recommendations from trusted sources. However, in addition to research, DeLuca strongly recommends collectors trust their instincts. An art advisor should make their client feel comfortable and confident. They should listen attentively to their clients’ needs and concerns and communicate very clearly, and welcome as much feedback as their clients have time for.

The advisor’s reputation should also demonstrate a history of integrity and professionalism. An advisor with fractured relationships within the industry is cause for concern. As DeLuca puts it, you don’t want to work with someone has to cross the street to avoid running into someone.

For collectors currently working with advisors, DeLuca recommends regularly evaluating the progress of their collections and the effectiveness of their advisor’s services. This includes everything from assessing their track record on successful acquisitions to sourcing competitive shipping quotes.

Some metrics for evaluating your art advisor’s performance include:

- Do their recommendations meet your specific goals, such as investment potential, aesthetic preferences, or thematic coherence?

- Have the values of the acquired artworks increased over time, aligning with the advisor’s predictions?

- Were the advisory fees justified by the financial gains or savings achieved?

- Is the condition of the artwork as expected, and has it been maintained or improved under the advisor’s guidance?

- Has the advisor provided accurate and insightful information about market trends and the artists’ potential?

- Has the advisor provided access to exclusive opportunities, such as private sales, auctions, or artist studios, that you wouldn’t have accessed on your own?

- Have you received the appropriate legal and tax documentation to maximize benefits like deductions?

- Does the advisor ensure thorough documentation and clear provenance for all acquisitions?

- Is your collection better organized and documented due to the advisor’s inventory management services?

BUILDING AND MANAGING AN ART COLLECTION

DeLuca not only offers comprehensive support building art collections but also in their maintenance.

When identifying potential acquisitions for his clients, DeLuca considers their goals, taste, budgetary constraints, and the long-term value of the work itself. Acquisitions are dependent on a collector’s access to the particular work; many of DeLuca’s clients’ acquisitions are from him leveraging his network of contacts to source high-quality artworks that are not offered to the general collector.

Integral to managing a collection is keeping detailed records (such as invoices, exhibition history, certificates of authenticity, and maintaining an image archive), offering conservation advice, obtaining condition reports, assisting with loans or exhibitions, sourcing insurance coverage, and coordinating the installation, storage, and sale of artworks as needed. Other maintenance includes arranging framing, creating renders of potential installations, or finding suitable storage options.

DeLuca also assists clients in planning for the future and enhancing their collections through customized software solutions (such as databases like Collectrium, Collector Systems, and Views), and estate tax planning.

Collectors should also regularly review their collections to assess its growth, relevance, and overall impact. Effective collection management involves adjusting acquisition strategies as needed—and seeking expert advice when making significant decisions is also advised.

COMMON MISCONCEPTIONS OF WORKING WITH AN ART ADVISOR

- Art advisors cost too much:

The cost of an art advisor is offset by the savings and value they bring through their expertise and negotiation skills. Art advisors are usually able to secure a discount for their clients on primary market works that offset their cost and source highly competitive shipping rates. - Bias towards certain artists or galleries:

There is a misconception that advisors might push certain artists or galleries due to personal preferences or hidden commissions. Reputable advisors always prioritize their clients’ interests and maintain transparency, and do not receive any commission from galleries or artists. - Limited to buying and selling artworks:

Beyond assisting with buying and selling artworks, art advisors offer a wide array of services including collection management, appraisal, conservation, and estate planning. - Unnecessary for experienced collectors:

Even seasoned collectors can benefit from an art advisor’s up-to-date market insights, access to exclusive opportunities, and professional network. - Advisors dictate taste:

Some believe advisors will impose their own tastes on clients, but a good advisor works to understand and complement the client’s personal preferences and collection goals. Advisors can enhance collecting by providing expert guidance while respecting the client's vision and preferences. - Focus only on expensive art:

Advisors deal with a wide range of art, including emerging artists. - Advisors are art dealers:

While dealers sell art, advisors offer unbiased advice and represent the client's interests without directly selling works themselves. Another key difference is that unlike art dealers, art advisors hold no inventory to sell.

-2023.jpg?auto=format&q=auto&fit=max&w=1020&h=600)